Table of Content

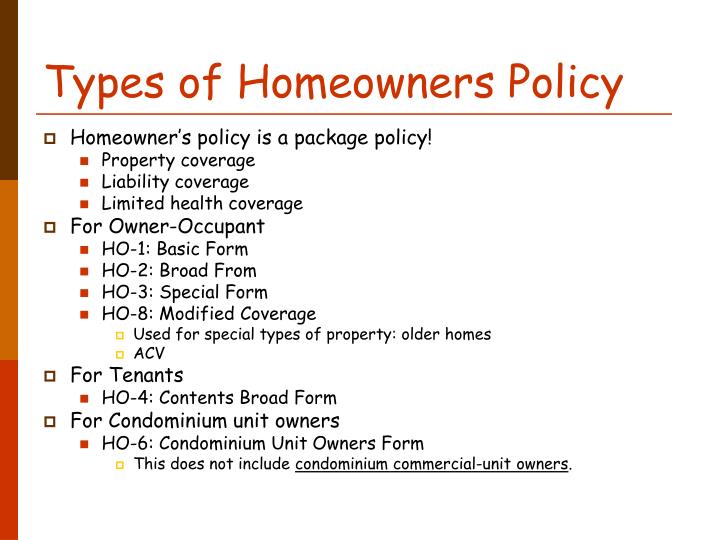

Personal property protection ensures you receive the necessary compensation to replace or repair those items. While you have plenty of options to choose from, the right policy protects at a reasonable price. Get peace of mind knowing you’ve protected it with homeowner’s insurance. The most popular type of homeowners policy form is the Special Form, commonly called HO-3.

If you have an older home or live in an area prone to natural disasters, your home insurance is likely to be more expensive. Having a home worth more will also increase your premium as you require a higher amount of dwelling coverage. You can use an online calculator, hire an appraiser, or use your previous policy's coverage limits as a starting point. But home insurance rates depend on specific factors, including your location, the age and construction of your home, its proximity to a fire station, and your claims history. According to the most recent data provided by Insure.com, U.S. homeowners pay an average annual insurance premium of $2,285.

Recommended Personal Property Coverage Amounts

Scheduled personal property—also called an endorsement, floater or rider—is an optional coverage that provides more coverage for expensive items you own. Among large home insurance companies, we found Progressive was the cheapest at an average of $1,236. Travelers was the most expensive at $2,871, which is $1,635 more than Progressive. If you’re reading this article, then the chances are that your house is worth more than $150,000, which means standard insurance policies won’t cover any damage done to it.

They're all located in Tornado Alley — a region of the country that sees frequent tornadoes and hailstorms throughout much of the year. Below is the monthly and annual average home insurance cost by state and how it compares to the national average. The average annual rate for a home with $400,000 in dwelling coverage and $300,000 in liability and $1,000 deductible is about $3,231, according to a rate analysis by Insure.com. But rates vary significantly from state to state and from city to city. Alani Asis is a Personal Finance Reviews Fellow who covers life, automotive, and homeowners insurance.

Flood Insurance

Certain materials are more vulnerable to fire, rotting and other dangers. For instance, homes with metal or tile roofs will likely have lower insurance rates than homes with asphalt roofs. In addition, some materials are more expensive to replace than others, like a marble countertop versus Formica.

Geographic location typically impacts your insurance rates because every area of the country has a different risk level for potential damages. Some areas may have a higher risk of wind damage, for example, while other areas of the country often sustain damage from fires. Every home is different, which means insurance companies rate each home on a case-by-case basis. Your home’s specific characteristics will play a role in determining how much you pay for homeowners insurance. Did you pass down your prized heirloom to a grandchild or sell off a bunch of personal belongings?

How Do You Calculate Your Home Insurance Needs

If you want more personalized help, contact your agent to calculate the home insurance needs for your location and type of house. Once again, if anything changes regarding factors like building materials and construction types, then make sure to update these amounts so that they’re accurate. These regions are vulnerable to hurricanes, flooding, and tornados, which drives up the average annual premium. Replacement cost coverage is the amount of money to replace an object or structure to its pre-loss state.

Typically, standard homeowners policies set liability coverage limits at $300,000 to $500,000, but some set as low as $100,000. Personal liability coverage is designed to protect your assets if you are sued due to bodily injuries or damage to property for which you are liable. The coverage extends to everyone in your household, as well as pets, and can help cover lawsuits, including court costs and damages.

Some insurers don’t cover hail and windstorm damage for homes located in coastal areas. If you live along or near the coast, look for a carrier that specializes in covering coastal properties. Your area may also have organizations that provide storm-related coverages.

You can also check the carrier’s financial-strength rating on the AM Best website. Some providers offer private flood insurance; others offer coverage through the National Flood Insurance Program. Insurers often set claims limits on certain types of property, such as sterling silver, jewelry, fur, money, firearms and stamps. However, the all-perils coverage only applies to damages to your home.

Home insurance costs vary from company to company, as every company has its own particular way of calculating rates and evaluating risk. Based on our analysis of the cheapest home insurance companies, we found that Erie's average home insurance rate in the lowest, followed by Auto-Owners and USAA. The average homeowners insurance cost for $300,000 in dwelling coverage with $100,000 liability is $2,763. If you bump liability to the recommended amount of $300,000, homeowners insurance with dwelling coverage for a $300,000 house has a national average of $2,779. Homeowners insurance covers your dwelling, personal property, offers liability protection, and covers you for additional living expenses if your home becomes inhabitable due to damage.

If you have a particularly "aggressive" breed as a pet, your insurance company may increase your rates. If you live in an area with high crime rates, stormy weather or are far away from a fire department, your insurance company will factor these and other risks into your insurance price. As with many types of insurance policies, it’s important to know exactly what you’re getting protection for.

This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. Homeowners insurance costs are rising, likely due to inflation, supply chain disruptions and increased costs for materials and labor. Our goal is to give you the best advice to help you make smart personal finance decisions.

No comments:

Post a Comment